Ready to take control of your retirement savings and explore a wider range of investment opportunities? Converting your 401(k) to a Self-Directed IRA (SDIRA) offers increased flexibility and diversification, but navigating the process requires careful planning. This comprehensive guide provides a step-by-step approach, demystifying the complexities and empowering you to make informed decisions.

Understanding Self-Directed IRAs (SDIRAs)

A Self-Directed IRA (SDIRA) is a retirement account offering significantly greater investment flexibility than traditional IRAs or 401(k)s. Instead of being limited to stocks and bonds, a SDIRA allows you to invest in alternative assets such as real estate, private equity, precious metals, and more. This expanded investment universe can lead to potentially higher returns but also carries increased risk. Is the potential for higher returns worth the increased risk and responsibility? Only you can answer that question.

Three Key Advantages of SDIRAs:

- Increased Investment Control: You decide where your retirement funds are invested.

- Diversification Opportunities: Access to a broader range of asset classes beyond traditional options.

- Potential for Higher Returns: While riskier, alternative investments can offer potentially higher returns than traditional investments.

Direct vs. Indirect Rollovers: Choosing Your Path

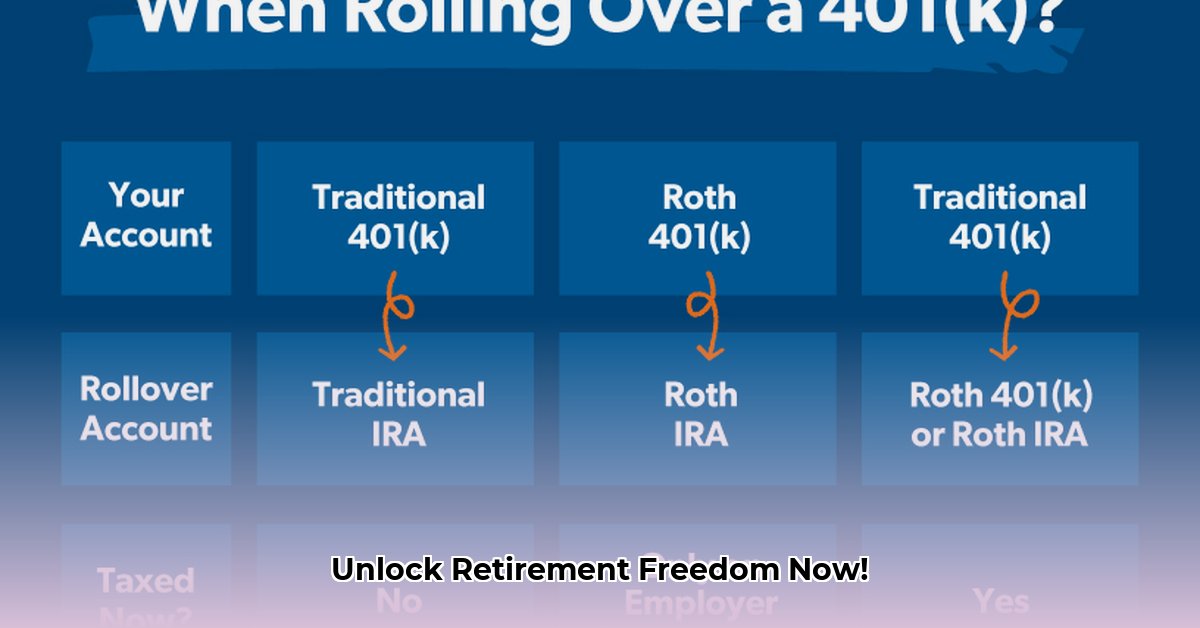

Two primary methods exist for transferring your 401(k) funds to a SDIRA: direct and indirect rollovers.

1. Direct Rollovers: This method involves your 401(k) administrator directly transferring funds to your new SDIRA custodian. This typically avoids tax withholding, a significant benefit. Did you know that a direct rollover can save you hundreds, even thousands, in taxes?

2. Indirect Rollovers: With this approach, you receive your 401(k) funds directly and then have 60 days to transfer them into your SDIRA. Missing this deadline triggers significant tax penalties. Given the strict 60-day time limit, is an indirect rollover the right choice for you?

Comparison of Direct vs. Indirect Rollovers:

| Feature | Direct Rollover | Indirect Rollover |

|---|---|---|

| Tax Withholding | Usually none | Potentially significant |

| Complexity | Simpler | More complex |

| Time Sensitivity | Flexible | Strict 60-day deadline |

| Risk | Low | Moderate (risk of penalties if late) |

Choosing Your SDIRA Custodian: A Critical Decision

Your SDIRA custodian manages your account, so careful selection is crucial. Consider these factors:

- Fees: Compare setup fees, annual fees, transaction fees, and per-asset fees across multiple custodians. A seemingly small difference in fees can accumulate to substantial savings over time.

- Services: Assess the level of customer support, online access, and investment tools provided.

- Reputation: Research the custodian's track record and online reviews. A reputable custodian provides peace of mind. "Choosing a reputable custodian is paramount for the long-term success of your SDIRA," states Sarah Miller, CFP®, Financial Advisor at Oakwood Capital Management.

Navigating IRS Regulations and Risk Management

Adherence to IRS regulations is paramount. Avoid prohibited transactions to prevent penalties. Maintain meticulous records of all transactions. "Thorough record-keeping is essential for compliance," advises David Lee, CPA, Tax Attorney at Lee & Associates.

Diversification is crucial for risk management. Spread your investments across different asset classes to mitigate losses. A well-defined investment strategy, tailored to your risk tolerance, is essential. Consult a financial advisor for personalized guidance.

Step-by-Step Guide to Converting Your 401(k)

- Research SDIRA Custodians: Compare fees, services, and reputation.

- Choose a Rollover Method: Decide between a direct or indirect rollover based on your circumstances.

- Complete the Rollover: Follow your chosen custodian’s instructions for initiating the transfer. This may involve completing specific forms and providing necessary documentation.

- Monitor Your Account: Regularly review your SDIRA account statements and transaction history.

- Seek Professional Advice: Consult a financial advisor or tax professional for personalized guidance.

Conclusion

Converting your 401(k) to a SDIRA offers significant advantages in terms of investment control and diversification. By carefully following the steps outlined in this guide and seeking professional advice when needed, you can successfully navigate this process and unlock greater retirement flexibility. Remember, thorough planning and due diligence are key to maximizing the benefits of a SDIRA while minimizing potential risks.